Note: Data below from February 2024 is the most recent from the National Association of Realtors.

Existing-home sales climbed in February, according to the National Association of REALTORS®. Among the four major U.S. regions, sales jumped in the West, South and Midwest, and were unchanged in the Northeast. Year-over-year, sales declined in all regions.

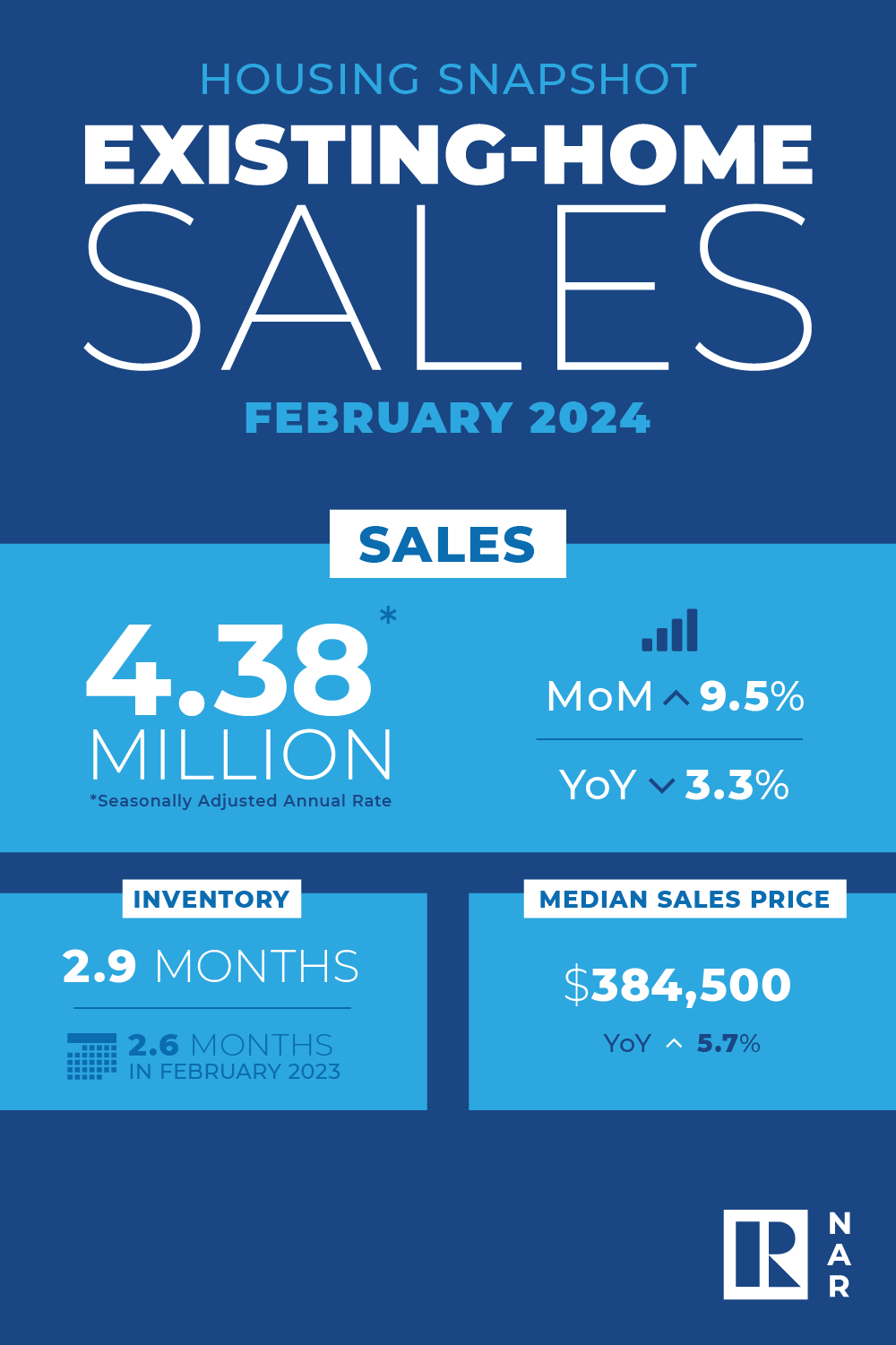

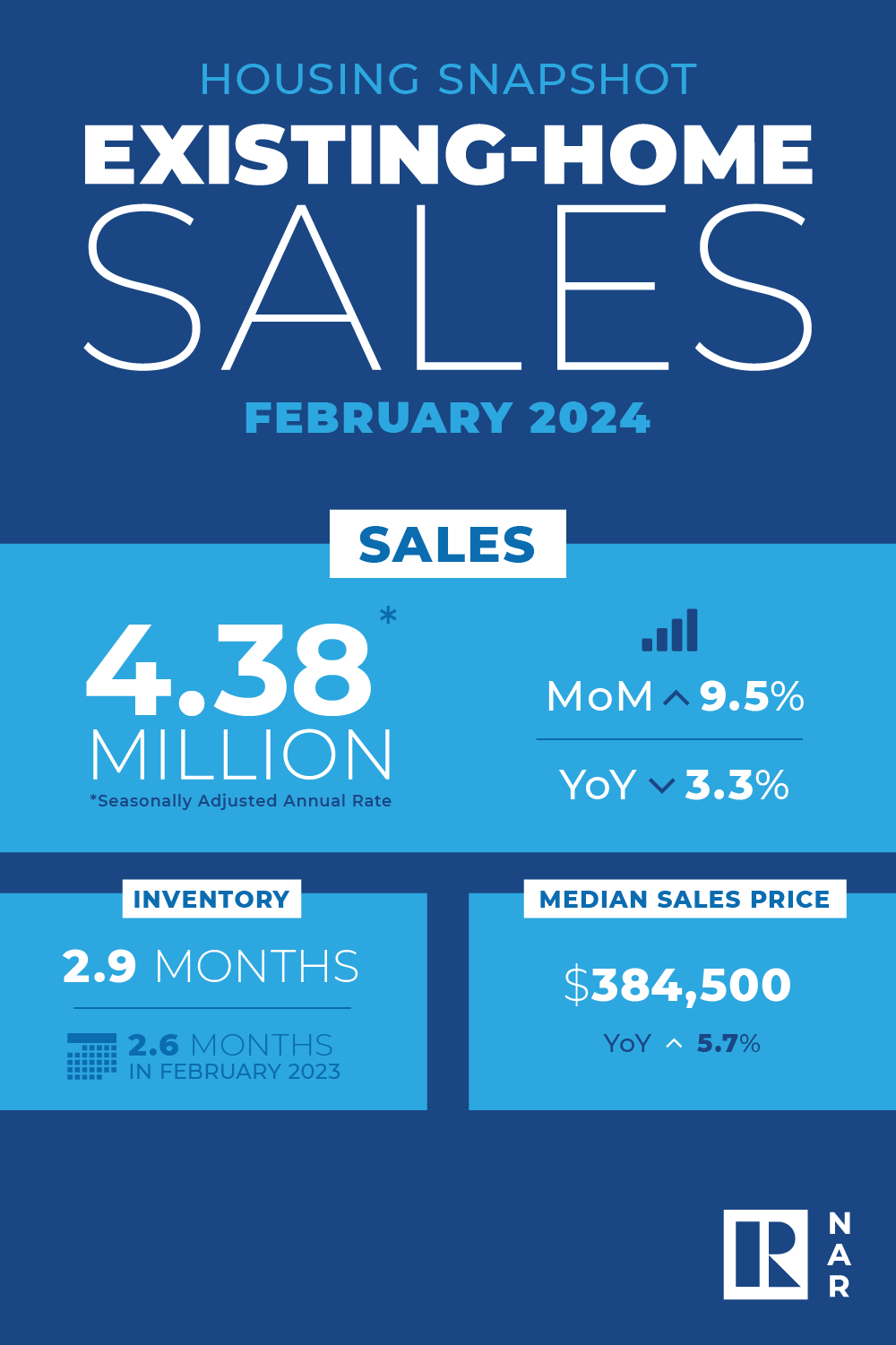

Total existing home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops - bounced 9.5% from January to a seasonally adjusted annual rate of 4.38 million in February. Year-over-year, sales slid 3.3% (down from 4.53 million in February 2023).

"Additional housing supply is helping to satisfy market demand," said NAR Chief Economist Lawrence Yun. "Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices."

"Additional housing supply is helping to satisfy market demand," said NAR Chief Economist Lawrence Yun. "Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices."

Total housing inventory registered at the end of February was 1.07 million units, up 5.9% from January and 10.3% from one year ago (970,000). Unsold inventory sits at a 2.9-month supply at the current sales pace, down from 3.0 months in January but up from 2.6 months in February 2023.

The median existing-home price for all housing types in February was $384,500, an increase of 5.7% from the prior year ($363,600). All four U.S. regions posted price increases.

According to the REALTORS® Confidence Index, properties typically remained on the market for 38 days in February, up from 36 days in January and 34 days in February 2023.

First-time buyers were responsible for 26% of sales in February, down from 28% in January and 27% in February 2023. NAR's 2023 Profile of Home Buyers and Sellers – released in November 2024 – found that the annual share of first-time buyers was 32%.

All-cash sales accounted for 33% of transactions in February, up from 32% in January and 28% one year ago.

Individual investors or second-home buyers, who make up many cash sales, purchased 21% of homes in February, up from 17% in January and 18% in February 2023.

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.74% as of March 14. That's down from 6.88% the prior week but up from 6.60% one year ago.

Regional Breakdown

At 480,000 units, existing-home sales in the Northeast were identical to January but down 7.7% from February 2023. It's the fourth consecutive month that home sales in the Northeast registered 480,000 units. The median price in the Northeast was $420,600, up 11.5% from one year ago.

In the Midwest, existing-home sales propelled 8.4% from one month ago to an annual rate of 1.03 million in February, down 3.7% from the previous year. The median price in the Midwest was $277,600, up 6.8% from February 2023.

Existing-home sales in the South leapt 9.8% from January to an annual rate of 2.02 million in February, down 2.9% from one year earlier. The median price in the South was $354,200, up 4.1% from last year.

In the West, existing-home sales skyrocketed 16.4% from a month ago to an annual rate of 850,000 in February, a decline of 1.2% from the prior year. The median price in the West was $593,000, up 9.1% from February 2023.

"Due to inventory constraints, the Northeast was the regional underperformer in February home sales but the best performer in home prices," Yun added. "More supply is clearly needed to help stabilize home prices and get more Americans moving to their next residences."

"Additional housing supply is helping to satisfy market demand," said NAR Chief Economist Lawrence Yun. "Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices."

"Additional housing supply is helping to satisfy market demand," said NAR Chief Economist Lawrence Yun. "Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices."